Employment Relations Compulsory Insurances

- Social insurance.

- Medical insurance.

- Employees insurance.

- Accident insurance.

- Unemployment insurance.

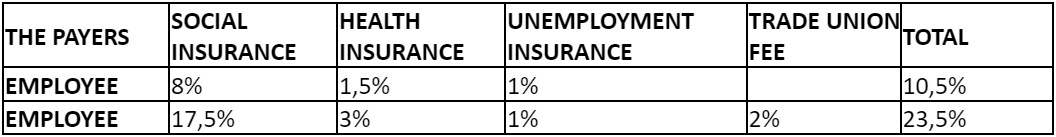

In accordance with the Law on Social Insurance (SI), which went into force in early 2021, the employers and employees have to contribute compulsory insurance and trade union as follows:

Total: 34% on the salary and wages:

- for the employer: 23,5%

- for the employee: 10,5%

The cap of the salary used as the basis for social insurance contribution is: 29.800.000 VND. It means, in case the salary exceeds the cap, the maximum contribution amount will be: 34% x 29.800.000 VND only.

Besides the compulsory insurance, you shall declare and pay PIT 20% on local incomes for non-resident expats and pay progressive tax rates from 5% to 35% depending on income levels for resident expats and local employees. The representative office only has to pay PIT.

Foreign workers in Vietnam with a work permit, or a practice certificate or license also going have to contribute health insurance and social insurance. The basis for social insurance contribution will be broadened to include salaries, allowances and other supplementary amounts.

For any information on Compulsory Insurances for Foreigners in Vietnam, please contact our team by email at info@opkofinance.com or by phone at +852 2654 8800.