Company Relocation and Land Appreciation Tax in China

Company Relocation and Land Appreciation Tax in China

May 23, 2018

Environmental protection is an increasing priority for China’s government. Since 2016, the Central Environmental Inspection Group has been getting serious on heavy polluters – especially in North China – and punishing firms that are rebellious with environmental laws.

Numerous companies in China have been influenced by this campaign, either directly or indirectly. A few businesses may end up in a hard situation, as they are facing spiraling operational expenses because of interruption of supply chains and more stringent environmental compliance requirements.

Companies in deeply polluting industries, for example, ceramics, papermaking, printing and dyeing, cement, and electroplating, have at times been asked to raise anti-pollution measures production techniques. Inability to do as such inside an assigned time allotment directly prompts penalties from environmental controllers and reduction or suspension of production.

In a few areas, local governments have reclassified the nature of land from industrial land to residential land and have moved highly-polluting plants outside of city centers to guard the residential environment.

In such cases, manufacturing companies may be confronted with production scale cut-downs, or migration to different territories with more moderate local policies, or even hold intends to plans production lines to Southeast Asian nations, for example, Thailand and Vietnam.

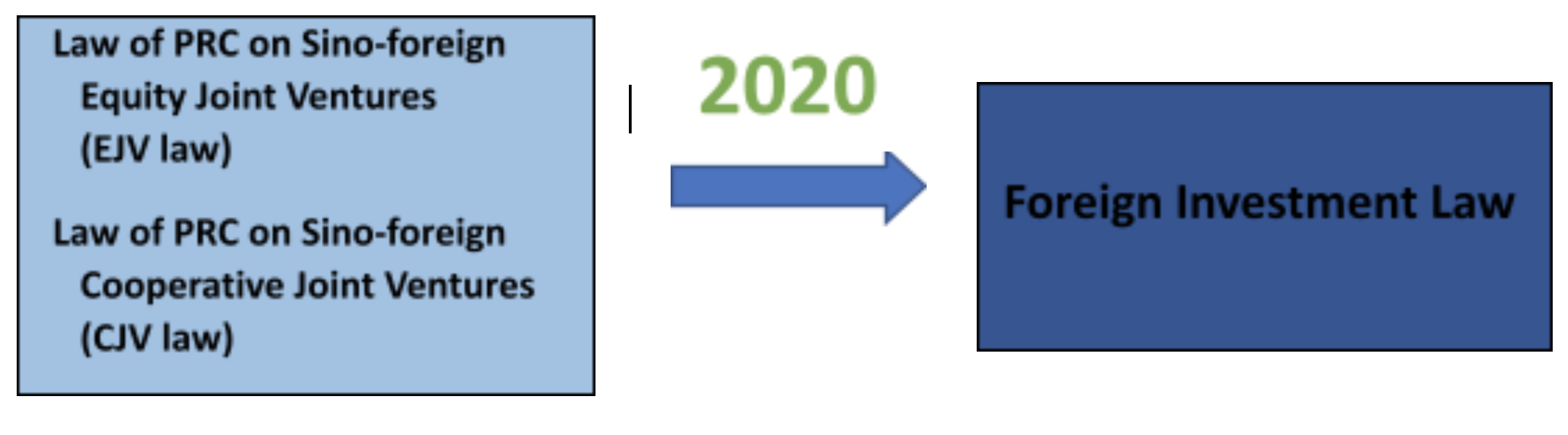

From a legal point of view, there are two primary approaches to relocate a business in China:

• Physically move the business to another area and adjust the work address, including an address change inside a similar city or across cities;

• Close the business and open another one, and move all assets, labor, and operations to the new company and location.

Cross city relocation through address modification sometimes may intrude operation of the business, as during the relocation, tax registration with the old city needs to be cancelled and there could be a timeframe before tax registration in the new city is prepared. An alternative method to relocate a business to a new business while keeping with the old company until the point that the better and brighter one is prepared.

At the point when a business is shut, all of its assets should be disposed and all liability should be settled. A few companies that hold land and structures, however, may encounter huge pressure from the taxes incurred by sale of the land and buildings.

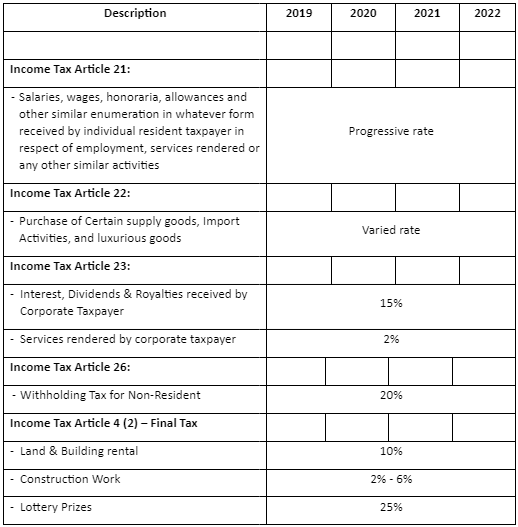

Taxes engaged in asset sales during a company closure will usually be value added tax, consumption tax, enterprise income tax, and land appreciation tax. Because of the quick development of real estate industry in China over the previous decade, the value of land and properties has expanded a few times over, which prompts a high land appreciation tax when the properties are sold.

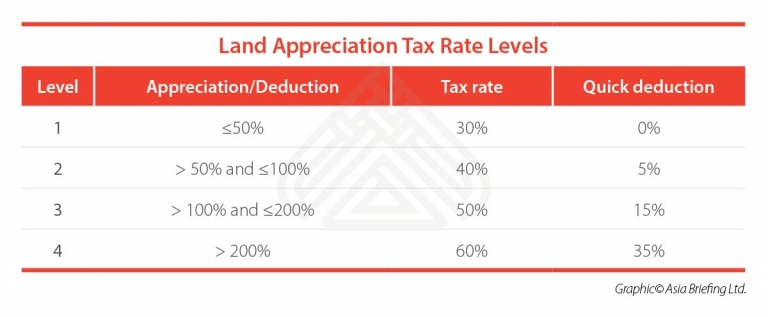

Land appreciation tax is required on paid transfer of state-owned land use rights, structures, and structures on that land. Estimation of land appreciation tax is based on the appreciation amount gained by the taxpayer and should be levied in accordance with a four-step progressive tax rate based on the percentage by which the appreciation amount is in excess of the amount of deducted items.

Land appreciation tax rates in China are:

Under any of the following conditions, land appreciation tax shall be exempted:

Where a taxpayer has constructed a normal standard housing unit for sale and the appreciation amount does not exceed 20 percent of the deductibles. The definition of “normal housing” is determined by the local government.

2. The real estate is expropriated or recovered pursuant to the law due to national development requirements, i.e. implementation of urban plans or state construction requirements.

Aforesaid ” implementation of urban plans” might mean conditions where the relocation is ordered by the government because of reformation of old cities or enterprise pollution or disruption (referring to excessive discharge of gaseous waste, sewage, waste residue, and noise that affect living conditions of urban residents) and relocated in accordance with the approved urban planning.

Aforesaid “state construction requirements” should mean conditions where relocation is required in order to implement construction projects confirmed by the State Council, provincial People’s Government, and the relevant ministries and commissions under the State Council.

Where the taxpayer needs to relocate and exchange the land because of the usage of urban plans or state development necessities, the transfer of real estate shall be exempt from land value-added tax according to this rule.

3. Where one party contributes land and one party contributes funds both parties cooperate in the construction of buildings, there will be a temporary exemption from land value-added tax if the completed buildings are allocated for each party’s own use in accordance with their respective contributions.

4. An individual who transfers residential housing shall be exempt from land value-added tax.

5. The mutual exchange between individuals of their own residential houses will be exempt from land value-added tax upon verification by the local taxation authority.

6. Other situations approved by the tax authority.

Taxpayers qualified for land appreciation tax exemption are required to present an application for the expense exclusion to the tax exemption to the taxation authority in the place where the real estate is located. Subject to examination and approval by the taxation authority, the taxpayer should be excluded from land value-added tax.

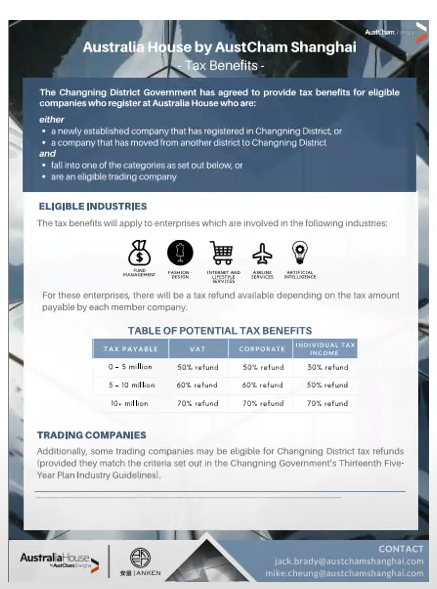

In order to optimize the market environment for mergers and rearrangements of enterprises, in 2015 the government provided some special policies for enterprises that are rebuilding, which qualified businesses for the land appreciation tax exception in specific circumstances.

On May 22, the Ministry of Finance reported to public that these strategies will be extended to December 21, 2020 and connected reflectively from January 1, 2018. The extension of the land appreciation tax exemption will reduce the burden on companies that must restructure during this period.

Let us know if you need anything else, OPKO Finance is ready to help you with any kind of question concerning the “Company Relocation and Land Appreciation Tax in China”, please feel free to drop us an email at info@opkofinance.com or contact us at + 86 187 177 31958.